Design and Deploy Innovative Research Solutions to Reach Vulnerable, Informal, and Periphery Populations

We help development organisations to create and use evidence across the project lifecycle to accelerate transformative change in hard-to-reach communities. Our specialisations include:

Hard-to-reach Populations

Bridging data gaps to reveal insights from often-overlooked communities.

Gender-based Research

Unraveling the impact of gender on various facets of economic development.

Youth Empowerment

Investigating challenges and opportunities to empower the next generation.

Digitalization and ICT Solutions

Assessing the transformative influence of technology on communities and economies.

Access to Justice

Researching pathways to enhance and democratize access to legal systems.

Anti-Corruption

Evaluating strategies to combat corruption and foster transparency.

Impact-oriented research that unlocks new opportunities and solutions

Our experience with inclusive customer discovery, human-centred solution design, and stakeholder mapping across East Africa makes us experts in overcoming the traditional sampling challenges that prevent generating actionable research and evidence.

Problems we target, which prevent actionable research and evidence generation

Problem Statement

Vulnerable, informal, and periphery populations often present challenges for researchers using traditional data collection techniques. For instance, individuals without access to the internet or smartphones may not be able to participate in online surveys; women may not be able to participate in in-person focus group discussions, when their time is consumed by domestic care duties; and the stakeholders of cross-border populations may be difficult to identify for researchers unable to work on both sides of the border.

Key Research Design Insight

Sauti’s approach to data collection is borrowed from our experience with human-centered solution design. We make it our first objective to understand the capacity and incentives of our target sample population to participate in our research. We then innovate data collection tools using mobile technologies that are inclusive, easy-to-use, and incentivise participants with access to information benefits that are designed to help them prosper in their communities.

Our approach enables us to overcome traditional data collection barriers and benefit from response rates that are far above the industry average.

Problem Statement

“Hard-to-reach” populations are often poorly mapped as a distinct and counted group. Qualitative population estimates can be useful to understand general behavioural dynamics, but may vary significantly as a quantitative indicator.

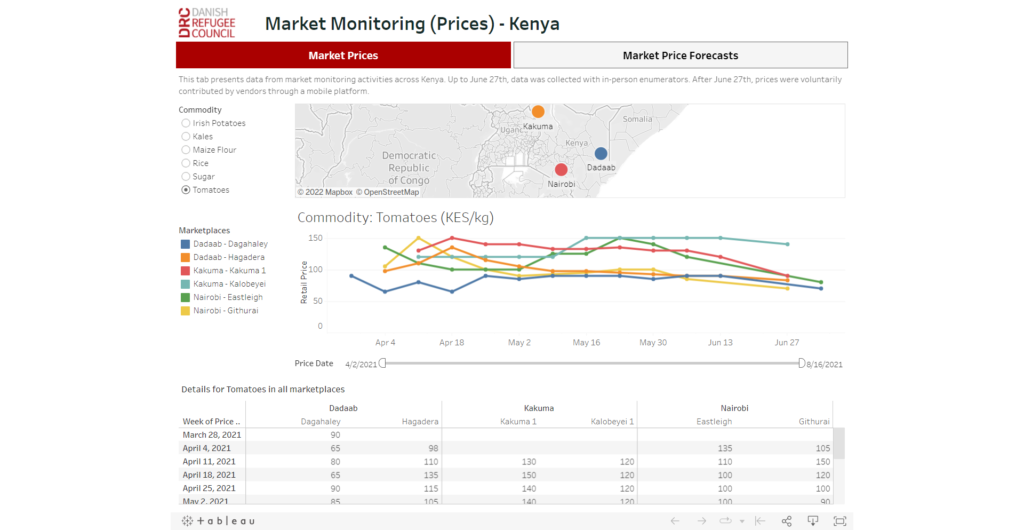

An illustrative example relates to the ratio of formal to informal trade in East Africa: with estimates of informal trade varying between 0.2 and 20 times formal trade. These estimates become more problematic when they are used to guide or evaluate representative sample selection: Without knowing the total population size, it becomes extremely difficult to evaluate representative sample selections.

Key Research Design Insight

Sauti’s approach to sample representativeness is two-fold. First, we design our data collection tools with the inclusivity and reach necessary to ensure participation by the maximum possible participating sample. Second, we correlate the demographic features of samples with our enormous databank of data we’ve collected in the past, allowing us to make precise interpretations of how representative a client’s data collection is of the overall MSME population in East Africa.

The cost effectiveness of our data collection tools, and our human-centered design approaches, have meant that we can reach a number of participants orders of magnitude larger than comparative quantitative studies. For example, our analysis of informal cross-border traders patterns of resilience included samples of more than 20,000 participants.

Problem Statement

Informal, rural, and poorer populations often occupy dynamic positions within regional value-chains. Farmers may become traders in the off-season, or engage in part-time work in services to supplement their income. Here, gender dynamics can determine dynamism within the value-chain too. The available incentives to participation in research can also influence how a participant chooses to identify themselves.

This dynamic switching of individual’s economic behaviour and often overlapping incentives can complicate the stratification of target samples, eventually threatening the validity of insights and utility of research recommendations.

Key Research Design Insight

Sauti’s treats sample identification and stratification as a distinct and significant part of the methodology design; which often requires action research to complete. Our local embeddedness in informal and rural communities throughout East Africa means that we have low-cost access to trusted networks across multiple value-chains, who we work with to accurately map and stratify populations.

By explicitly including stakeholder populations at the design stage, we can more fully understand their motivating incentives, their overlapping priorities, and ultimately how we can ensure accurate and inclusive research and actionable insights.

Tailored Research and Evidence Solutions

Our local embeddedness in the regional trade environment and our digital assets mean that we can provide development sector researchers with unique and actionable insights to making a positive impact in the region.

Agricultural Value Chain Analyses

- Map key stakeholders and explore the dynamics that impact women and youth participation.

- Validate evidence on agricultural value chains.

- Identify and prioritize trade corridors for maximum impact.

Trade Policy Assessment

- Assessments for opportunities and gaps in continental and regional trade-related policies and frameworks.

- Provide evidence-based recommendations for enhancement, reform, and implementation.

Non-tariff Barrier Identification and Solutions

- Assess the effectiveness of regional and continental platforms for reporting, monitoring and eliminating non-tariff barriers.

- Propose evidence-driven recommendations for trade system improvements.

Trade Partner and Network Mapping

- Map and profile continental and regional-level stakeholders, including business associations, councils, cross-border trade associations, women, and youth groups.

- Provide evidence-backed insights to enhance program implementation, localization, and engagement.

Monitoring, Impact Evaluations, and Learnings

- Identify baseline indicators and monitor programme implementation throughout project life-cycles

- Leverage quantitative and qualitative indicators for nuanced learnings.

How we work

We leverage rigorous methods and robust data collection tools to uncover new ways to support innovation.

Design & Sample Frame

Implementation

Synthesise

Detailed scoping to understand objectives and tailor approaches

We apply our local expertise in rigorous research and evaluation methods to help clients uncover better ways to use evidence. We start with:

- Understanding which data collection methods can work, why, where, and for whom.

- Establishing preliminary baseline data and sampling frames from our Sauti Trade Insights datasets of more than 100,000 MSMEs.

- Using our questionnaire database to designing inclusive and sensitive survey tools suited to hard-to-reach communities.

Bespoke data collection tools

We use data collection technologies that are best-suited for the target sample. Whether it’s remote data collection (via SMS, USSD, and WhatsApp), in-person enumerators, focus group discussions, or expert interviews, we maximize precision and accuracy

Drawing from practical experience as a leading innovator in East Africa, we also understand how to engage hard-to-reach populations, such as informal, vulnerable, or periphery communities, to generate useful insights and analysis. Read more

Actionable insights

We leverage our expertise as policy experts to collaborate with project teams to ensure research deliverables are useful for practitioners.

Whether your aims are to improve programme design, engage stakeholders or create community buy-in within your organisation, we can help you to translate knowledge into practice.

Our Data Collection Toolkit

In-person Surveys

We conduct in-person surveys to gather firsthand insights and data directly from individuals through face-to-face interviews or questionnaires.

Focus Group Discussions

In focus group discussions, we gather insights through structured group interactions, facilitating open dialogue among participants to explore perceptions, opinions, and experiences related to specific topics or issues.

Remote Data Collection

Remote data collection using SMS, USSD, or WhatsApp offers benefits such as increased accessibility, cost-effectiveness, real-time data collection, wider reach, and the ability to engage with respondents in their preferred communication channels.

Key Informant Interviews

Our local embeddedness in East Africa’s MSME, trade, and agricultural communities gives us unique access to individuals that often possess specialized knowledge or expertise for our clients. Through interviews with these individuals, we can gain deeper insights and nuanced perspectives to inform decision-making and program implementation

Behavioral Observation

We systematically monitor and analyze how individuals interact with information resources, including their usage patterns, engagement levels, and decision-making processes. This approach provides valuable insights into user behaviors, preferences, and needs, informing ongoing platform optimization and user-centered design efforts.